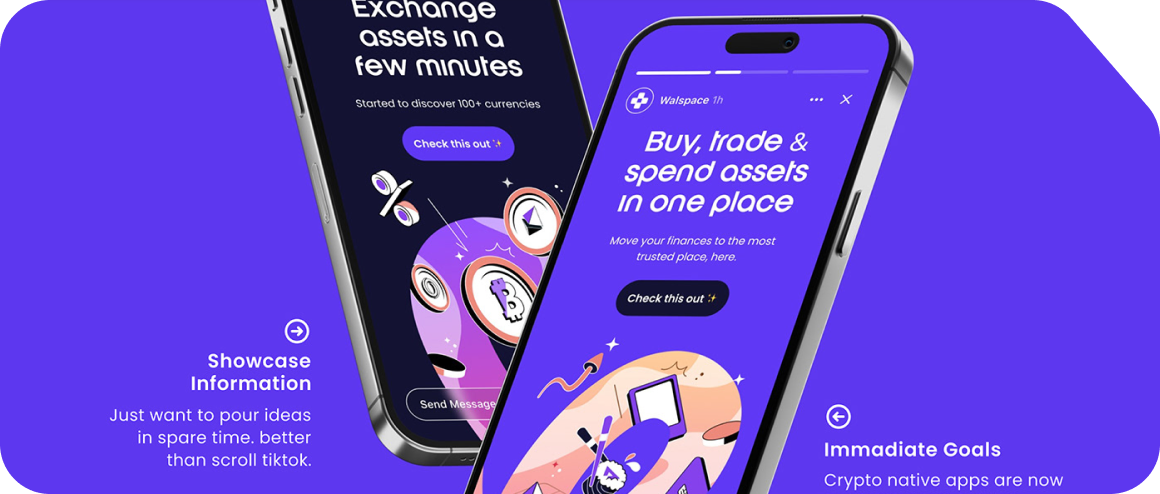

Introduction :

This case study dives into the development and success of “Upay” a mobile wallet app designed to simplify personal finance management. In a market filled with competing options, Upay carved a niche by focusing on a specific user group and offering unique features.

Challenge :

Millions of young adults struggle with budgeting and financial literacy. Existing wallet apps cater to a broad audience, lacking features specifically tailored to this demographic’s needs. Upay aimed to bridge this gap, empowering young adults to take control of their finances.

Solution :

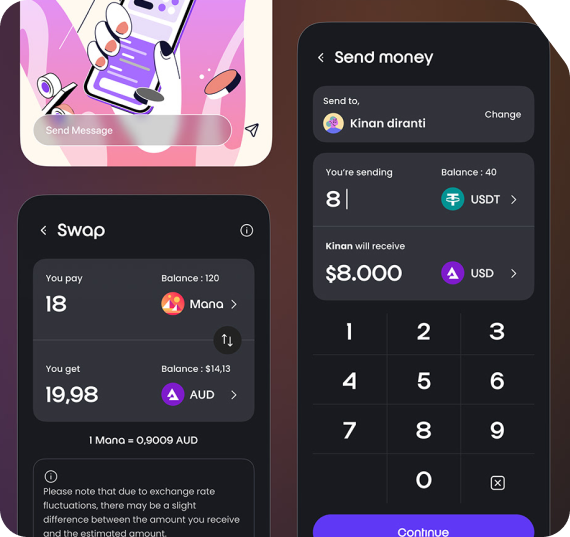

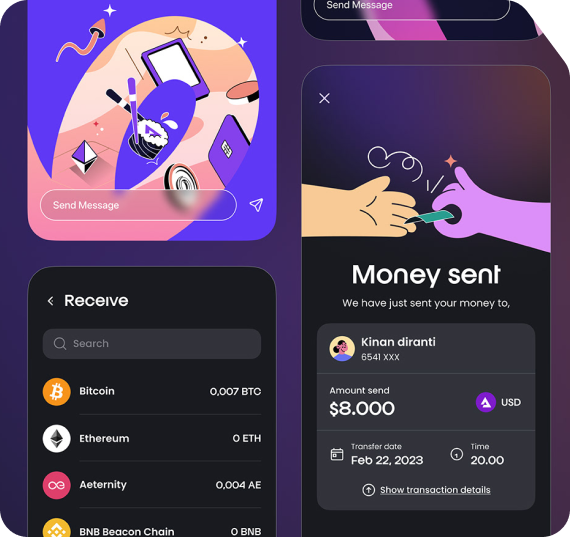

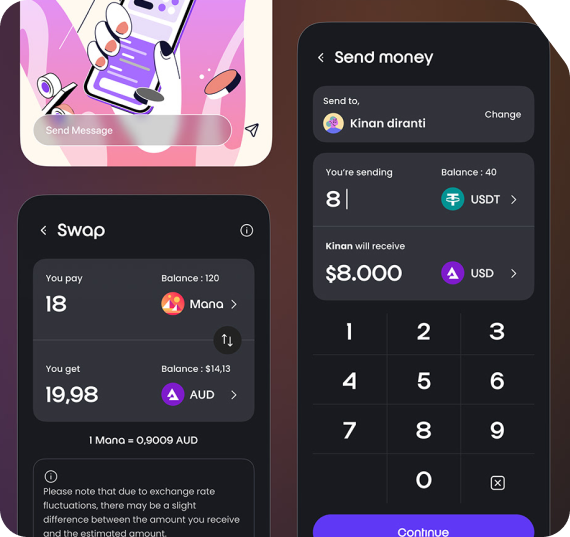

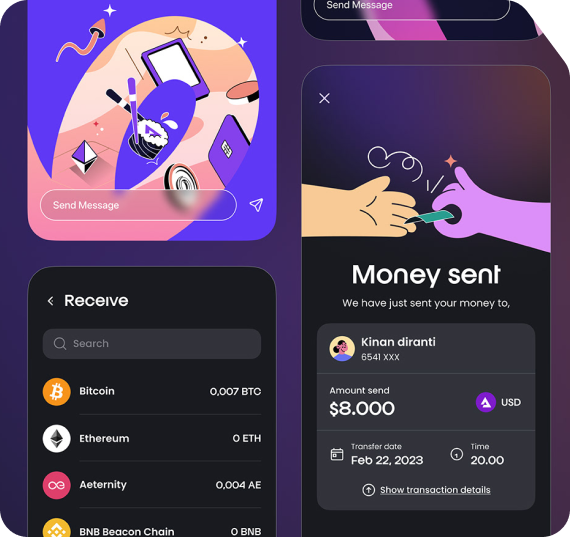

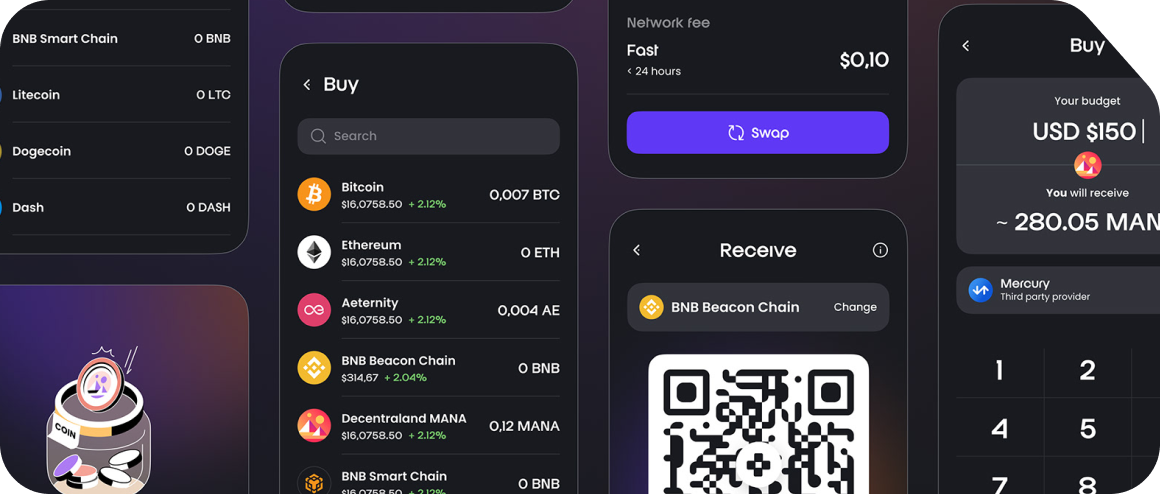

UPay offered a user-friendly interface with features like:

- Personalized budgeting tools: Goal-setting, expense tracking, and category-based spending analysis.

- Integrated educational resources: Articles, tips, and quizzes on financial literacy delivered in an engaging format.

- Social budgeting: Collaborative features like group budgeting and shared wallets for roommates or couples.

- Gamification elements: Rewards and badges for achieving financial goals, fostering positive reinforcement.

- Seamless integration with popular financial institutions: Easy account connection and transaction tracking.

Results :

Upay achieved impressive results:

- 100,000 downloads within the first 6 months: Exceeding initial projections.

- 85% of users actively using budgeting tools: Demonstrating significant engagement.

- Increased financial literacy scores among users: Validating the impact on financial well-being.

- Positive user reviews and media coverage: Highlighting the app’s value and innovation.